Raw Material Report January/February 2020

Check predictions for walnut crop, Hazelnut prices and estimates for other nuts, kernels and dried fruits

Almonds

Both shipment numbers and receipts are impressive for the new year!

Shipment year to date are up by 4-5% and total supply currently exceeds this figure. So the need is higher shipment numbers!

In general, the impact of those high receipts will dominate buyer (and seller) behavior in the nearest future.

The bloom has started and until today, all parameters for the bloom look pretty much perfect! The ground is moist enough due to the heavy rainfalls of past month. Reservoirs are full; so water (for this crop year) should not be an issue. Forecasted temperatures look great as well.

Most buyers will continue to buy hand to mouth and will try to move Q2 shipments into Q1. February is likely to be a very strong shipment month as most sellers are already fully booked.

Nonetheless, there is plenty of buying to be done for Q2/Q3 shipments and buyers will try to wait as long as possible.

Our recommendation is to further closely observe the weather patterns during the bloom.

The only downside at the moment is the currency.

One new factor has arisen!

Due to the Corona Virus business into China is slowing down drastically. As of today we have no idea how this virus will further impact business to China or business to other parts of the world.

Dried apricot

Exports in January were a steady 8,977 tons, compared to 8,288 tons last year. Year to date exports are 58,780 tons compared to 57,887 tons last year.

Average price for diced apricots year to date is $2116 FOB compared to last year same period of $2172

Average price for whole apricots year to date is $2753 FOB compared to $2757 same period last year

Prices are almost identical to last year with exports increasing by approximately 1.5% year to date. Crop was smaller than last year. With 6 months to go until new crop, we expect exports to approach 100,000 tons which means a tight transition to new crop and no carryover.

We expect prices to remain steady until frost period in March and April. In the event of a rare frost free bloom prices are still expected to remain unchanged until August given the tight supply situation. In the event of a frost prices will firm according to the severity.

The Turkish Lira has been stable over the past month and is currently at 5.99 to the $

Organic and natural apricots continue to trade at a significant premium to sulphured and are all but sold out.

Winter has been a little milder than usual but the trees are still fully dormant and no signs of an early blossom are yet visible.

Walnuts

WALNUT MONTHLY MANAGEMENT REPORT AND DISCUSSION

HIGHLIGHTS

1) Monthly inshell (total) equivalent shipments -21.1% vs. PY

• Export inshell equivalent shipments -26.6% vs. PY

• Domestic inshell equivalent shipments -5.7% vs. PY

2) Year to date inshell (total) equivalent shipments -5.4% vs. PY

• Export inshell equivalent YTD shipments -7.4% vs. PY

• Domestic inshell equivalent YTD shipments -0.8% vs. PY

3) Monthly inshell only shipments -56.36% vs. PY with Domestic -72.88% and Export -55.95%

• Key highlights include Turkey -74.1% vs. PY, Italy -42.32%, UAE -71.5%, Vietnam up 543%, India +98.5%

4) Year to date inshell only shipments -12.95% vs. PY with Domestic -35.19% and Export -11.83%

• Key highlights include YTD inshell shipments to Turkey up 6.14%, up 3.81% to India, -23.7% to UAE, -16.1% to Vietnam, +19.6% to Germany, +5.05% to Italy, +9.85% to Spain, -99.66% to Pakistan.

DISCUSSION

This report verifies what the industry has been feeling the past month! A slowdown in sales across the board. This down performance combined with an additional 10,000+ ton of inshell walnut receipts create an increasing challenge for the California Walnut industry going forward.

To date, crop receipts of 650,730 inshell ton is now only -3.3% from PY 672,723 inshell ton receipts with total supply -2.6% vs. PY. This differs greatly from the opinions of some packers 4 months ago who believed tonnage would not surpass 600,000 ton. The 5 month YTD sales versus PY are -5.4% compared with that of last months (4 month) YTD sales which was -1.49%. This shows the industry losing ground yet current inventory is still -2.6% vs. PY. Recall that last year’s prices were significantly lower and monthly sales numbers higher due to prices that were about 30% lower on inshell and 25% on kernel. While this makes year over year monthly comparisons difficult, it does highlight which effect significantly higher prices has on demand.

What a difference a month makes. Last month, with YTD inshell equivalent sales -1.49% but with a crop that was -4.54%, packers did not ring the alarm. After this month’s performance and more importantly the overall quietness pervading the industry, there is increasing concern. Some packers are hopeful that Chile’s drought will not put forth a bumper crop and lower prices. This should be a front burner topic of conversation at Gulfood this week. Other packers point towards China’s large crop and significant export sales being negatively impacted due to the Corona virus and the resulting closure of some Chinese ports not allowing shipments to go out. Somewhat wishful thinking.

Chinese Walnuts

Not much change from the last report. The overseas markets would not seem to have an advantage buying out of CA and most likely will revert back to China to fill their upcoming requirements. Many overseas buyers are working through Chinese shipments and have reported good quality. China is currently offering LAH80% USD4700, LH80% USD5400, LP USD5200 CFR. This may take California out of certain markets moving forward due to price. What impact will the Corona virus have on exports if key ports are closed?

Inshell Prices and Kernel Prices

Inshell prices for Jumbo/Large Chandler have recently been done in the $1.30/lb range from about $1.15/lb at the start of the season and compared to last year of about $.95 - $1.05/lb. Chandler LHP 20’s currently in the $3.15 to $3.20/lb range. Domestic LHP is in the $3.00 - $3.05/lb range and Combo Halves and Pieces in the $2.90/lb to $2.95/lb range. Chandler halves are in the $3.50 - $3.60/lb range. Sales are quiet. As we predicted in December the quietness can be deafening and packers don’t like the sound of it. When they are looking for drought concerns out of Chile or shipment issues out of China to help the Californian Walnut Industry there is concern.

Existing Inventory and sales position

Going over the California Walnut Board 2019 Orchard Run Production by County, Variety and Percent of Crop we see is that the Chandler percentage of crop is 59.91 % and other varieties are 40.09%. If, for 2020 we hold Chandler production steady at 389,838 ton and we revert the “other” varieties to the 2018 crop of 324,462 inshell ton, then the total would be 714,300 ton. Might this be a forecast of what might be possible for 2020 or maybe more? This potential of what could be will also weigh on the minds of packers not wanting to carry over very much inventory at all.

At present, Chandler material is abundant. Packers do not seem to have an oversupply of combo or domestic light product but there are goods available to buy. Pieces are starting to become more available in light color less so on combo. Packers had been content on packing to schedule but are looking for future month orders to fill in their schedule. Most packers we talk to are 80% – 90% sold which tells us that there are either some large packers or many small to medium packer’s or both that we don’t speak with who are undersold.

What we know and don’t know

• The crop is mostly final at 650,730 ton.

• At Gulfood, Chile will put forth information on their crop, quality and no doubt look to book business but at what price?

• Inshell sales going forward will be very slow. When will packers begin to earnestly crack inshell and force feed the kernel market?

• What impact will the Coronavirus have on Chinese exports of walnuts if their ports are closed? Can they ship goods? Will a back-up in China reduce their already cheap prices once they begin to ship normally?

• India recently raised the tariff on February 2, 2020 on US kernel from 30% to 100% (with Inshell already at 120%). On inshell, 100% is a general tariff on imported walnuts with an additional 20% retaliatory tariff on US origin walnuts. The kernel is set at 100% and is detailed on the Government of India document, Chapter 8, item 1. What impact will this have on existing California walnut containers headed that direction? If there is trouble, packers will have to deal with the hardship of the “No Objection Certificate” if they (had not done so ahead of time) in order to re-export those containers elsewhere.

• Cold storage season will begin in April 2019 and will motivate packers to want to move goods out.

CONCLUSION

The January 2020 MMR report is seemingly bearish yet the North American market is only -0.8% behind PY and inventory is only up 0.2% but with much higher prices. California has clearly lost some momentum and is -5.4% YTD sales vs. PY. California only has “one tool in their toolbelt” to stop the trend and this is price. Their hope for facilitative news out of Chile and China is wishful but there is still about 8 months to go before new crop and plenty of time to right the ship and sell the crop, but most likely not at these prices

pistachios

The pistachio report showed the industry to be continuing progress along the track which we have figured they would, given the off crop this year which has now finalized at 730 million lbs. Overall shipments were down -20.91%. Export shipments overall for December were -29.19% and YTD are down -29.18%. Shipments to Europe were minus 35.45% and YTD are -28.09%. Asia, including China/HK and India were -12.34% in December and YTD a mere minus 31.52% overall. Shipments to the Middle East were -44.31% and YTD at -37.12%.

Domestic shipments were down for the month -13.61% but are still up 4.66% YTD. Canada and Mexico were -7.06% for the month but are still up 2.27% YTD.

Commentary:

Although the US domestic market experienced a slight hiccup in December, it, along with Canada & Mexico continue to be consistent and expect it to remain that way.. In general, export shipments are tracking about 30% off of last year and we expect that will continue for the remainder of the year. This seems to be the number that California needs to target for export shipments and particularly open inshell. As long as we continue to manage this level in the export markets and shipments do not drop off measurably beyond this, we expect the market will be fairly stable for the remainder of the year. As of today, it still seems that California will end the year with a manageable carryout number going into 2020 crop, which by all accounts should be a record for California. Early estimates are the 2020 crop should eclipse the 1billion lb. mark. We have had adequate rain and chilling hours so far. If the positive conditions continue, the question will become, by how much?

Export demand and in particular, Asia demand, from January through August is still likely the largest variable in achieving this carryout. China / HK have been measured leading up to Chinese New Year. It is understood that the market is not too long on product and will need some further coverage, however purchases for post CNY have been limited so far. Europe seems largely covered, but has been picking up goods hand to mouth as needed. We expect they, along with most all other markets, will be hand to mouth as much as possible leading up to the transition into 2020.

Kernels:

Kernels remain a bright spot for California. Shipments are up 10% domestically even given the firm prices. And we have seen recent launches by the two largest processors on flavored pistachio kernel packs which could accelerate the growth. Export shipments of kernels are up 26% YTD. Although shipments of closed shell are off by nearly 50%, with the lower percentage of shelling stock from the 2019’ crop as well as the lower amount of closed shell, look for kernel pricing to remain firm and availability to be tight the rest of the year.

Open Inshell:

As noted, Domestic shipments continue to be consistent. We are positive the domestic shipments will hit 200 million lbs. as we originally thought given the hiccup in December, but they should be close. If the export shipments of open inshell continue to track 30% below last year’s shipments Jan – August we should end up with 50-55 M lbs. of carryout of natural open. This number seems like a comfortable number for California, but if the crop is looking good through the spring and into summer / nut fill, it still could put a little pressure on California to get this stock moved out sooner than later.

Going forward, we will continue to watch shipments fairly close, as now most variables of the 19 crop are known, the exception being demand going forward. Pricing over the past month has stabilized across the industry and currently pricing for Raw Extra #1 21/25 sits at $4.20 - $4.25. 80% kernels have remained stable at $7.70 - $7.90 /lb.

cASHEWS

Vietnamese crop continues to be positive with farmers reporting good arrivals. Prices remain attractive, with some stability at current levels as demand from factories picks up as they re- start after the holidays.

The Ivory Coast government announced a 400 CFA minimum farm-gate, up from 375 CFA last year, have upped the export Levy to approx. USD 125 / Mt also up from last year, and finally the season has officially opened three week earlier than normal. We have to see how effective the government will be in enforcing this price. Unlike the past two years there is no carry over of old crop, plus being an election year they might be more determined to see this through to keep farmers happy.

This has jolted the RCN market in Africa as neighboring Ghana and Nigeria were expecting higher prices out of IVC and a later season opening. Already concerned about the impact of the Corona virus on cashew demand, the African RCN markets have come down more in line with Vietnamese prices this last week.

With news of good crops and concern about Corona virus, kernel buyers have preferred to stay out and watch the development. However, it must be noted on both issues it’s still early days. The majority of the crops still have to come to market, and though trade to China on Cashews has almost stopped. It is only a week since the market re-opened after the holidays. Traditionally, this is anyway the most quiet period of trade to China so there is no backlog of kernel stock building yet.

RaisinS

The drought in Chile will impact prices for the new season.

We will even see smaller sizes and less available quantity especially for flames duo as they have been taken away from a lot of farms.

In South Africa crop seems to be good and prices for Thompsons raisins has came down during the last season.

In California prices remain stable.

Turkish Sultanas remain stable.

hazelnuts

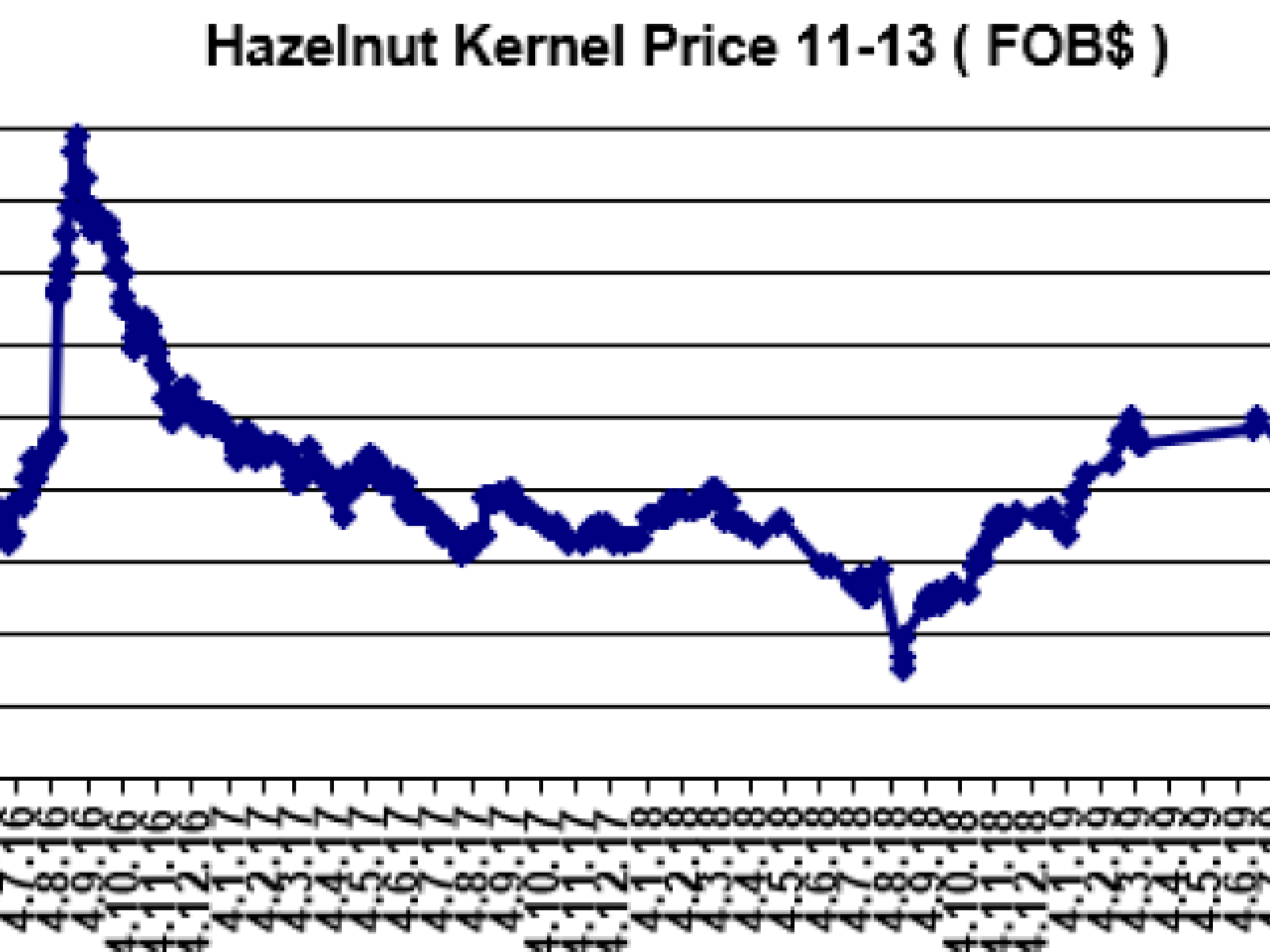

Prices have increased since Christmas as estimated before. A lot of demand from EU and from Asia. Sellers in Turkey prefer to keep the rawmaterial in their stock, and wait for TMO’s sales prices. TMO had bought the merchandise at 16,50 YTL/kg in the beginning of the season, and now market prices reach to min. 20,00 YTL/Kg, meaning TMO will not announce any price lower than 19,50-20,00 YTL/kg. This issue and coming demands are pushing up the prices.

Summary at the moment there are demands but not much available raw material in the market. Prices will not decrease in the short term based on Turkish lira.

Hazelnut prices

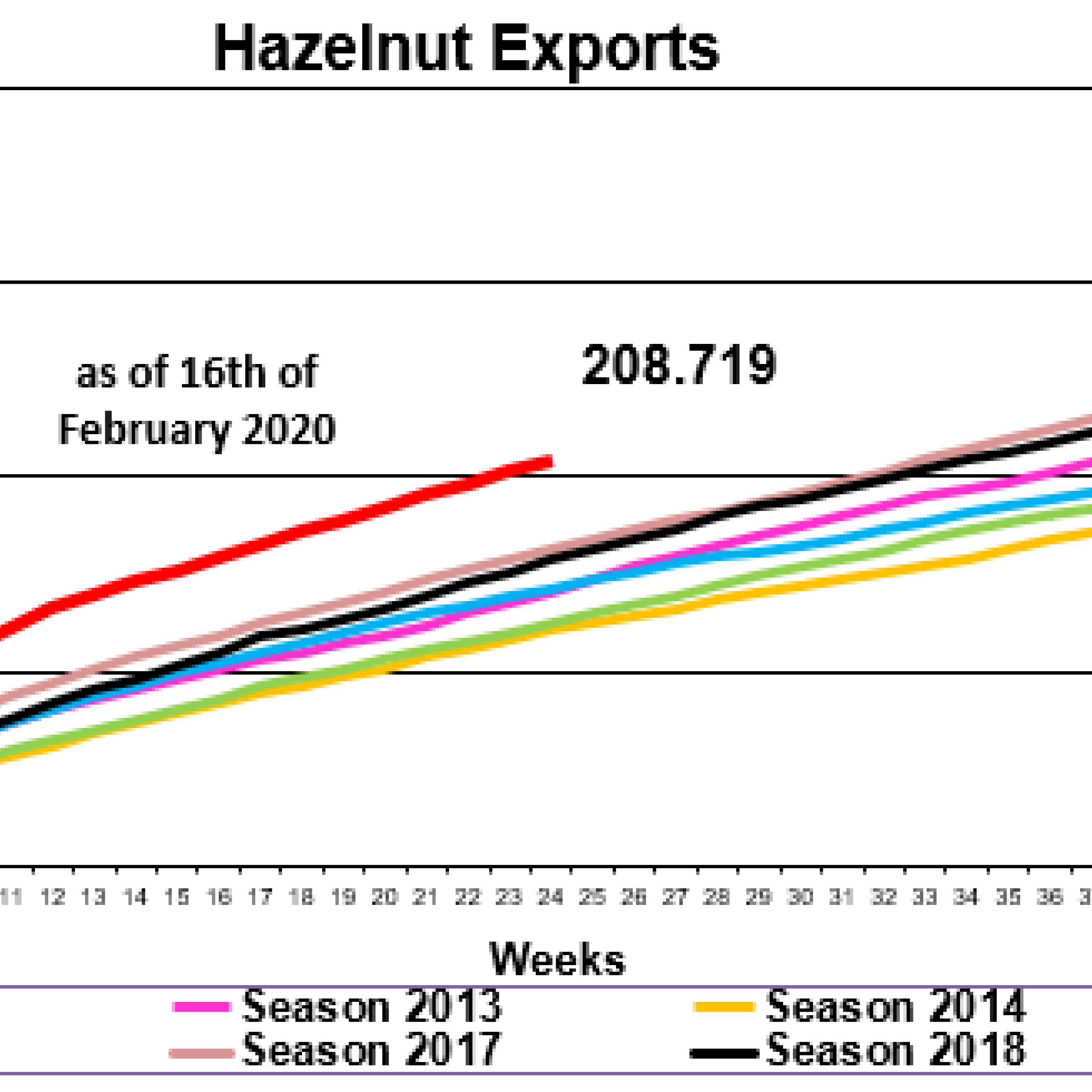

Hazelnut export